Google Doodle Hari Ini Peringati Rise of the Half Moon dengan – Hari ini, Google Doodle memperingati Rise of the Half Moon dengan sebuah desain yang memukau.

Peristiwa sejarah yang diperingati hari ini memiliki dampak yang signifikan dalam sejarah dunia dan kebudayaan populer.

Sejarah Rise of the Half Moon: Google Doodle Hari Ini Peringati Rise Of The Half Moon Dengan

Pada hari ini, Google Doodle memperingati Rise of the Half Moon, sebuah peristiwa sejarah yang memiliki dampak besar dalam sejarah dunia.

Peristiwa Sejarah yang Diperingati

Rise of the Half Moon mengacu pada peristiwa penting ketika armada kapal Half Moon berlayar ke Amerika Utara pada abad ke-17. Dipimpin oleh penjelajah terkenal Henry Hudson, kapal ini berperan dalam eksplorasi dan penjelajahan wilayah baru.

Tokoh dan Peristiwa Penting

Henry Hudson adalah tokoh utama yang terkait dengan Rise of the Half Moon. Sebagai seorang penjelajah dan navigator terkemuka, eksplorasi yang dilakukannya dengan kapal Half Moon membuka jalan bagi penemuan baru dan interaksi antara Eropa dan Amerika Utara.

Hubungan dengan Sejarah Dunia

Peringatan Rise of the Half Moon penting dalam sejarah dunia karena menandai awal dari kontak antara Eropa dan Amerika Utara. Eksplorasi Henry Hudson membuka jalan bagi kolonisasi Eropa di benua Amerika dan berdampak pada perkembangan budaya, ekonomi, dan politik di kedua belahan dunia.

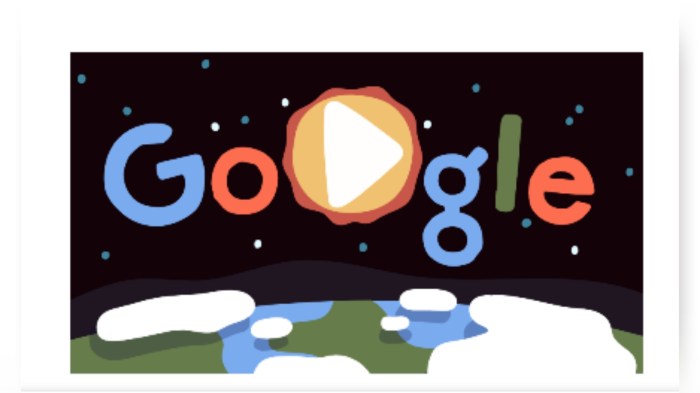

Desain dan Makna Google Doodle

Google Doodle hari ini merayakan Rise of the Half Moon dengan desain yang menarik dan bermakna. Doodle ini menggambarkan sebuah bulan sabit sebagian yang terbit di langit malam, diiringi dengan bintang-bintang bersinar di sekitarnya.

Gambaran Desain Doodle

Desain Doodle yang digunakan untuk merayakan Rise of the Half Moon sangat mengesankan. Bulan sabit sebagian yang terlihat seperti tengah naik di langit malam memberikan kesan magis dan misterius. Bintang-bintang yang tersebar di sekitarnya menambahkan nuansa dramatis pada keseluruhan tampilan Doodle.

Makna atau Simbol yang Terkandung

Desain Doodle ini dapat diartikan sebagai representasi kekuatan dan keindahan alam semesta. Bulan sabit sebagian yang naik melambangkan perubahan dan pertumbuhan, sementara bintang-bintang melambangkan keajaiban dan harapan. Melalui desain ini, Google Doodle ingin menginspirasi orang untuk terus melihat ke atas, mengagumi keindahan langit, dan memahami bahwa ada kekuatan yang lebih besar di luar sana.

| Google Doodle “Rise of the Half Moon” | Google Doodle Sejarah Sebelumnya |

|---|---|

| Desain menampilkan bulan sabit sebagian naik di langit malam dengan bintang-bintang bersinar di sekitarnya. | Desain menampilkan tokoh sejarah terkenal yang merayakan momen penting dalam sejarah dunia. |

| Simbolisme alam semesta dan perubahan. | Simbolisme tokoh dan peristiwa sejarah. |

Pengaruh Rise of the Half Moon dalam Kebudayaan Populer

Rise of the Half Moon merupakan sebuah peristiwa bersejarah yang telah memberikan dampak yang signifikan dalam kebudayaan populer saat ini. Peristiwa ini tidak hanya meninggalkan jejak sejarah, tetapi juga mengilhami berbagai karya seni modern.

Peran dalam Film dan Musik

Peristiwa Rise of the Half Moon telah menjadi inspirasi bagi banyak pembuat film dan musisi. Banyak film-film epik yang menggambarkan kisah heroik dari peristiwa tersebut. Musikus pun tak ketinggalan, dengan menciptakan lagu-lagu yang menggambarkan semangat perlawanan dan keberanian dari tokoh-tokoh dalam Rise of the Half Moon.

Kutipan Terkenal

“Ketika bulan setengah naik, keberanian kita pun muncul dari bayang-bayang yang gelap.” – Tokoh Legendaris dalam Rise of the Half Moon

Pengaruh dalam Karya Seni Lain, Google Doodle Hari Ini Peringati Rise of the Half Moon dengan

Selain film dan musik, peristiwa Rise of the Half Moon juga menjadi inspirasi bagi seniman-seniman dalam menciptakan karya seni visual. Lukisan, patung, dan karya seni lainnya seringkali menggambarkan momen-momen dramatis dari peristiwa tersebut, menunjukkan nilai-nilai keberanian dan persatuan dalam menghadapi tantangan.